In today's busy digital world, technology plays an important role in virtually every facet of organization operations. One location where modern technology has had a significant influence is in the procedure of applying for organization financings. For services in Sun City, The golden state, understanding just how innovation can influence their service funding application can lead to extra efficient, clear, and effective results. Provident Bank, a leading banks in the region, leverages sophisticated modern technology to improve the financing application process, making it less complicated for businesses to protect the financing they require. This blog checks out the numerous methods modern technology can influence your company finance application.

The Digital Transformation of Company Lending Applications

Speed and Effectiveness

1. Online Applications

Gone are the days when business owners had to go to a bank personally to make an application for a loan. Today, lots of banks, including Provident Bank, provide on-line application platforms. These systems enable services to finish and send loan applications from the comfort of their office or home, conserving time and decreasing the headache connected with standard paper-based applications.

2. Automated Processing

Advanced algorithms and automation tools can refine loan applications much faster than manual approaches. This suggests that applications can be examined and authorized faster, reducing the waiting time for services. Provident Bank's use of automated processing systems guarantees that businesses can obtain choices on their funding applications in a prompt manner.

Boosted Precision and Openness

1. Information Assimilation

Technology enables the assimilation of various data resources, which can be made use of to validate information offered in financing applications. This minimizes the likelihood of errors and ensures that the information is accurate. For instance, Provident Bank can incorporate financial data from audit software or financial records to verify a service's economic health.

2. Clear Tracking

On-line systems typically come with monitoring functions that enable candidates to keep an eye on the status of their financing application in real-time. This transparency assists organizations stay notified and lowers the unpredictability connected with the financing approval process.

Improved Client Experience

1. User-Friendly Interfaces

Modern financing application platforms are developed with individual experience in mind. User-friendly user interfaces and clear instructions make it simpler for company owner to browse the application procedure. Provident Bank's on-line application system is designed to be user-friendly, guaranteeing a smooth and simple experience for applicants.

2. Customized Help

While innovation promotes self-service alternatives, it additionally enhances personalized support. Provident Bank supplies specialized Organization Financial police officers that can provide tailored support and assistance throughout the lending application process. Advanced CRM systems assist these policemans access appropriate information swiftly, guaranteeing they can assist clients more effectively.

The Function of Innovation in Assessing Creditworthiness

Data-Driven Choice Making

1. Big Data Evaluation

Banks are progressively using large data analytics to evaluate the credit reliability of finance applicants. By assessing huge amounts of information, financial institutions can get understandings right into a company's economic wellness, market trends, and threat variables. Provident Bank leverages huge information to make informed lending choices, making certain that credit scores evaluations are based on thorough and accurate information.

2. Option Credit Report Scoring Models

Traditional credit history versions rely greatly on historical monetary information, which might not always offer a full photo of a business's creditworthiness. Modern technology enables using different credit scoring models that think about a larger range of elements, such as social networks task, consumer testimonials, and supply chain connections. These models can give an extra alternative view of a company's credit reliability, particularly for more recent organizations that might not have a substantial financial history.

Machine Learning and Artificial Intelligence

1. Predictive Analytics

Machine learning and expert system (AI) are changing the way financial institutions evaluate loan applications. Anticipating analytics can recognize patterns and fads that may not be immediately obvious through conventional evaluation. Provident Bank utilizes AI-driven tools to forecast the likelihood of finance repayment, enabling more precise and fair loaning decisions.

2. Risk Analysis

AI and machine learning algorithms can boost danger evaluation by analyzing different risk elements and generating risk ratings. These scores aid banks determine the proper rate of interest and lending terms for each and every applicant. By utilizing sophisticated danger evaluation tools, Provident Bank can provide customized funding solutions that satisfy the certain requirements of each company.

The Influence of Technology on Financing Approval Prices

Raised Access to Financing

1. More Comprehensive Applicant Pool

Innovation has actually democratized accessibility to funding by enabling a lot more companies to obtain finances. Online platforms and alternate credit history designs make it feasible for organizations that might have been overlooked by conventional lending institutions to protect funding. Provident Bank's comprehensive approach ensures that a broader range of companies in Sunlight City can access the financing they need.

2. Innovative Financing Solutions

Fintech advancements have introduced new lending services, such as peer-to-peer financing and crowdfunding, which offer alternative financing choices for organizations. While Provident Bank largely concentrates on standard financing, it remains familiar with these fads and continuously seeks to introduce its offerings to better offer its customers.

Improved Loan Authorization Rates

1. Enhanced Credit Report click here Assessments

By leveraging advanced modern technologies for debt analysis, Provident Bank can extra precisely review the credit reliability of applicants. This lowers the possibility of declining creditworthy organizations and enhances overall car loan authorization rates.

2. Customized Car Loan Products

Modern technology makes it possible for financial institutions to supply even more customized funding products that fulfill the details demands of different companies. Provident Bank's ability to customize finance terms and conditions based on thorough risk assessments and predictive analytics makes sure that more businesses can find suitable financing options.

The Future of Business Funding Applications

Blockchain and Smart Dealings

Blockchain modern technology and wise agreements have the potential to revolutionize business lending application procedure. By providing a protected, transparent, and tamper-proof document of transactions, blockchain can streamline the loan approval and disbursement process. Smart contracts can automate the execution of lending contracts, guaranteeing that funds are released only when predefined conditions are fulfilled.

Boosted Information Protection

As organizations come to be extra dependent on digital platforms, information protection comes to be an essential problem. Provident Bank buys advanced cybersecurity actions to shield sensitive financial details and make certain the personal privacy of its clients. Future advancements in information file encryption and protected verification techniques will better boost the safety of on-line funding applications.

Combination with Emerging Technologies

The combination of arising innovations, such as the Net of Things (IoT) and enhanced reality (AR), can provide added information points and insights for credit scores evaluations. For example, IoT gadgets can keep an eye on the performance of financed equipment, while AR can offer digital site gos to for residential property evaluations. Provident Bank continues to be fully commited to exploring these innovations to improve its borrowing processes.

Final thought

Technology has actually greatly impacted business lending application procedure, offering various benefits such as increased speed, accuracy, openness, and boosted consumer experience. For companies in Sunlight City, California, recognizing how these technological improvements influence funding applications can bring about much more effective and successful outcomes.

Provident Bank leverages cutting-edge technology to streamline the loan application procedure, making sure that organizations obtain the funding they need promptly and effectively. By accepting data-driven decision-making, advanced credit report analyses, and cutting-edge loaning services, Provident Bank is well-positioned to support the diverse funding requirements of Sun City's service neighborhood.

As modern technology remains to develop, the future of organization funding applications guarantees also better effectiveness, security, and ease of access. By staying notified about these developments, businesses can better browse the funding application process and protect the financing essential to accomplish their growth and success.

Don't hesitate to contribute your ideas. Follow along for additional bank in hemet today.

Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Batista Then & Now!

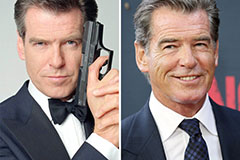

Batista Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!